Student loan debt is a topic that heavily affects the majority of homebuyers across the country. According to Education Data Initiative, 14.8 Million millennials have student loan debt, Which is more than any other generation. Millennials carry an average balance of $38,877 per borrower. In Washington State alone there is roughly $8.8 billion dollars of student debt across 275,500 millennials. The amount of debt one has when graduating from school undoubtedly affects when they are able to purchase a home.

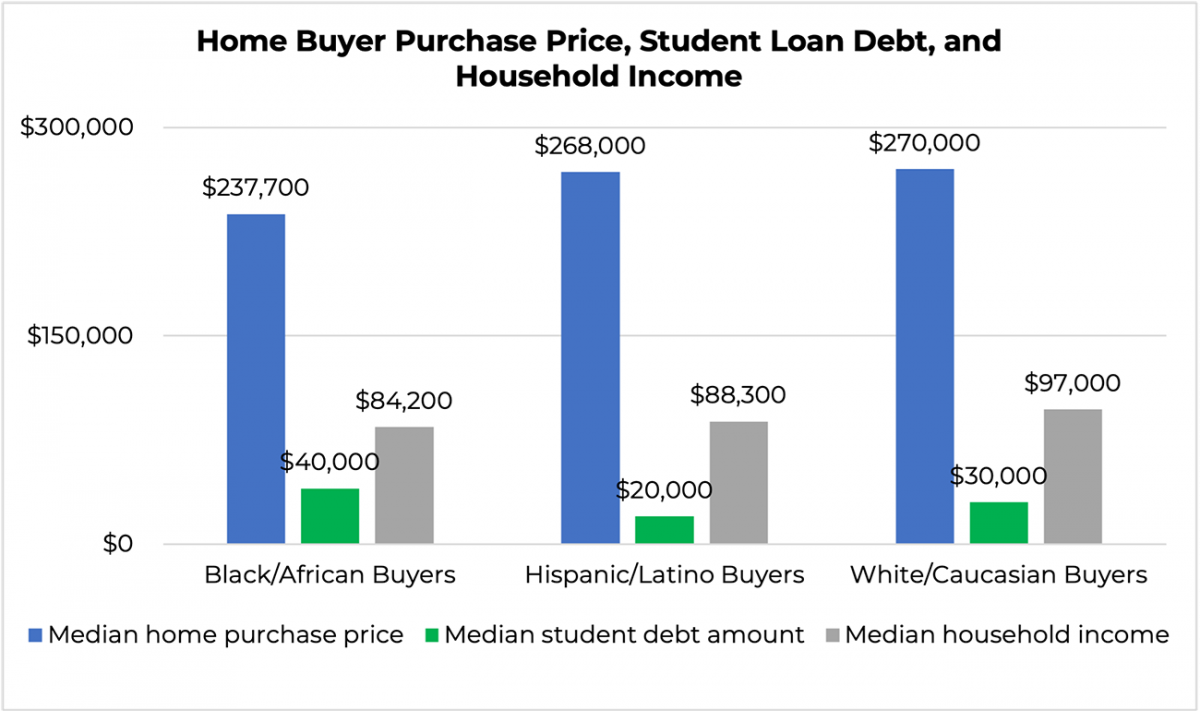

When examining student loan debt and how it affects homebuyers, it is imperative to not overlook the correlation to race. According to NAR.com, “the homeownership rate gap now for Black and White homeowners is as wide as when the Fair Housing Act started in 1968.” The homeownership rate for White individuals is 73.3%, while Black homeownership is 42.1% and Hispanic/Latino homeownership is 47.5%. On average, Black home buyers have $10,000 more debt than White home buyers. Hispanic/Latino home buyers have the least amount of student debt at $20,000 (on average); however, it is critical to note that White home buyers carry the most graduate or doctoral student debt, compared to Black and Hispanic/Latino home buyers who carry debt from undergraduate schooling. Black home buyers carry the most student loan debt which significantly hinders the amount Black home buyers can put towards a downpayment or towards saving each month.

The outcome from disproportionate student loan debt is a topic that needs to be highlighted as well. Black home buyers carry the most student loan debt which leads to a disadvantage when saving for a downpayment. With less money for a downpayment, the median home price for a Black home buyer is 12% less than the median home price of a White home buyer, which ultimately leads to a disadvantaged opportunity for long-term wealth gains.

*Source: National Association of REALTORS® 2021 Snapshot of Race and Home Buying in America

*Source: National Association of REALTORS® 2021 Snapshot of Race and Home Buying in America

We often hear or read articles on how and why student debt hinders or delays the opportunity to purchase real estate. However (and more importantly) we need to learn and discuss how student loans and race play a huge role in homeownership. Read the full survey on NAR.com.